Should I buy the dip?

For quite some time I've been monitoring the markets, and waiting for a dip to invest my cash. However, a few weeks ago I decided to put this assumption to the test. Is buying the dip the best I could do with my hard earned cash?

The context

- Like most employees, I have a salary and some yearly disposable income to dedicate to my long term savings or investments. Concretely, I have about £20000 a year to dedicate to my investments.

- I decided to invest only on indexes, because I got burned with individual stocks (and crypto) multiple times (a.k.a. I am a terrible investor).

- Long term investments only. Monitoring the market daily/hourly is a massive drain of energy and time that I could dedicate to generate more cash to invest.

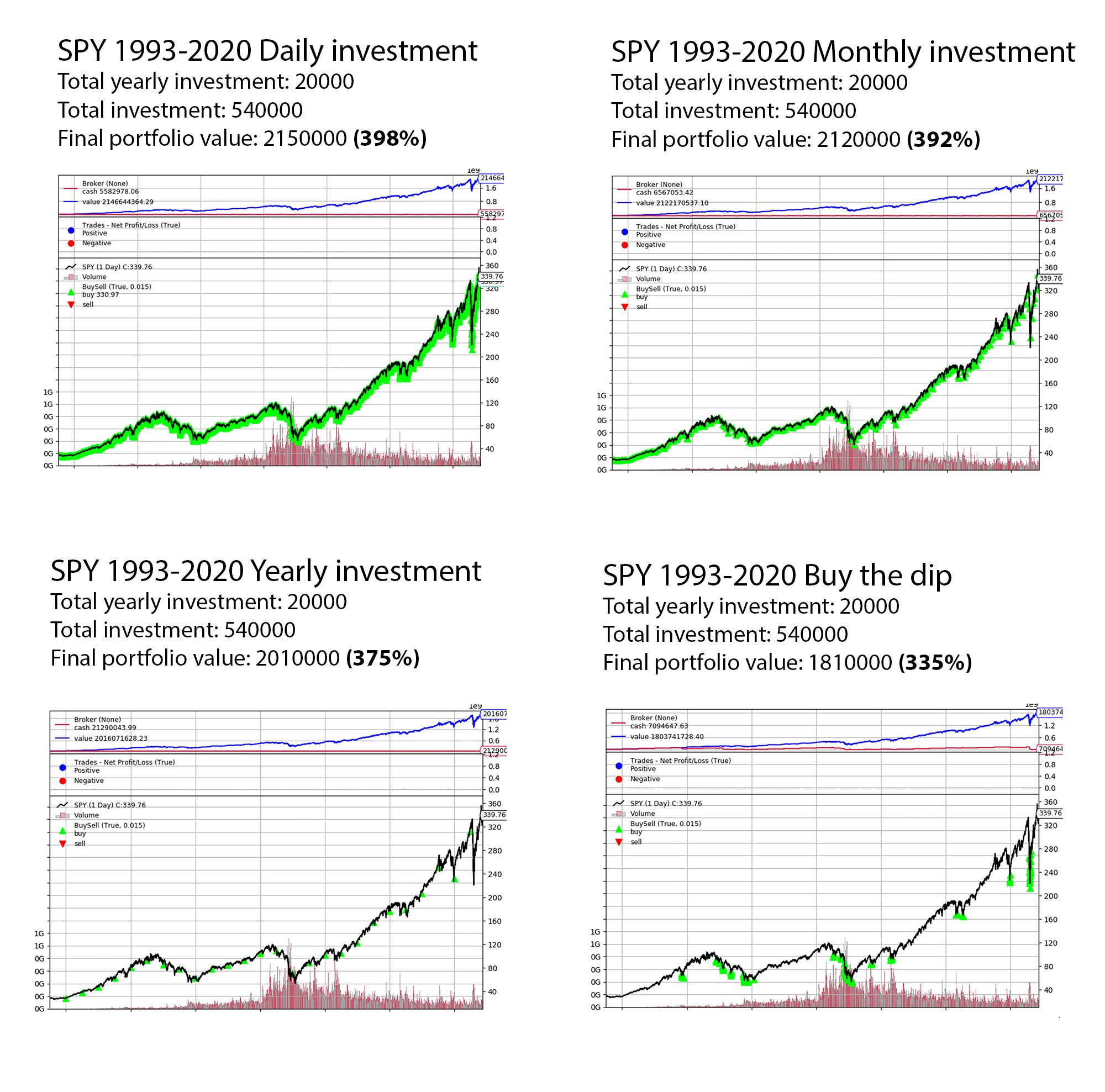

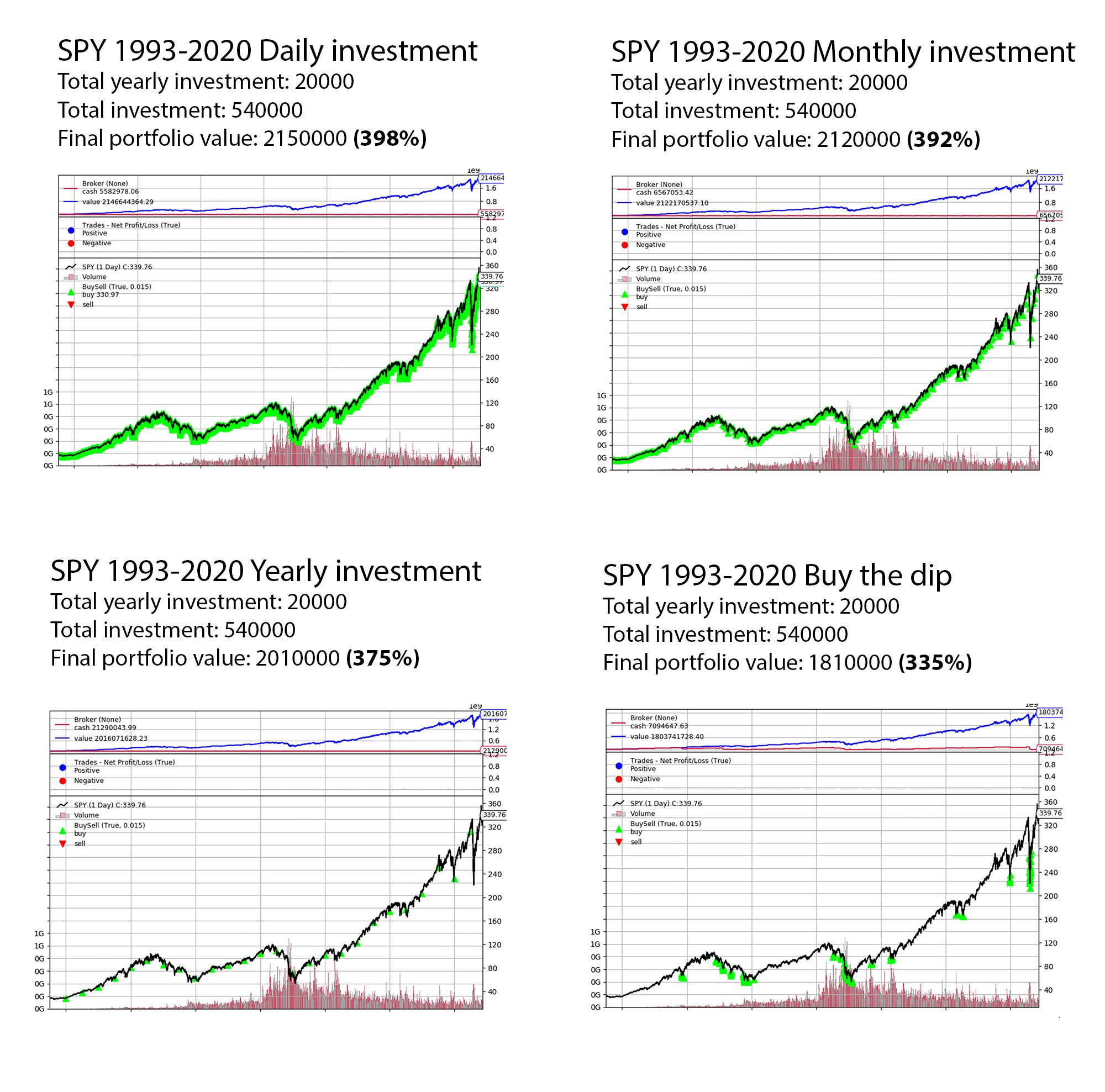

The scenarios

- Buy daily same amount (Hardcore dollar cost averaging strategy)

- Buy monthly same amount (Simple dollar cost averaging strategy)

- Buy yearly same amount (Extremely simple dollar cost averaging strategy)

- Buy the dip (My own shitty-wait-for-it-and-spend-shit-tons-of-time-monitoring strategy)

I used Python + Backtrader library to simulate my scenarios, and these were the results investing on the SPY ETF, ignoring commission fees because my broker offers zero commission transactions.

Conclusion

This experiment was quite revealing for me, because it showed me that the return of investment (ROI) for spending 27 years monitoring the markets daily could easily be negative, compared with a hands-off strategy like dollar cost averaging monthly to the SPY.

If previous return history is an indicative of future returns, the extra time dedicated to monitoring the market without a clear edge is a waste of time, which is also a waste of money.

The main takeaway is don't try to beat the market, just invest at set intervals on some diversified indexes, and don't look back, regardless of what the market does. Spend the extra time generating more cash to invest, and the magic of compounding and dollar cost averaging will do the rest.

Follow me on Twitter @carlosbaraza if you like this type of content and I'll make more.

Other notes:

- The difference between investing daily, monthly and even yearly is pretty much negligible long term. Short term, it makes a bigger difference, being daily the best approach if your broker offers zero commissions.

- This strategy depends on the market continuing appreciating. If the market was ever to reverse permanently, this strategy, and pretty much every strategy would fail.

Disclaimer

I am not a professional investor, nor a financial advisor, and arguably not even a good amateur investor. This is just a simple experiment I run because I waste a lot of time and energy monitoring the market.